In a significant policy shift, China’s Ministry of Finance has announced reductions and cancellations to its export tax rebate program, effective December 1, 2024. This move directly impacts key industries such as aluminum, copper, photovoltaics (PV), and batteries, with the rebate for some of these products being slashed from 13% to 9%, while others, including aluminum and copper, will see the rebate completely removed.

Given China’s dominant role in global supply chains—particularly in the solar and aluminium sectors—these changes are set to send ripples through international markets, with notable industry-specific consequences.

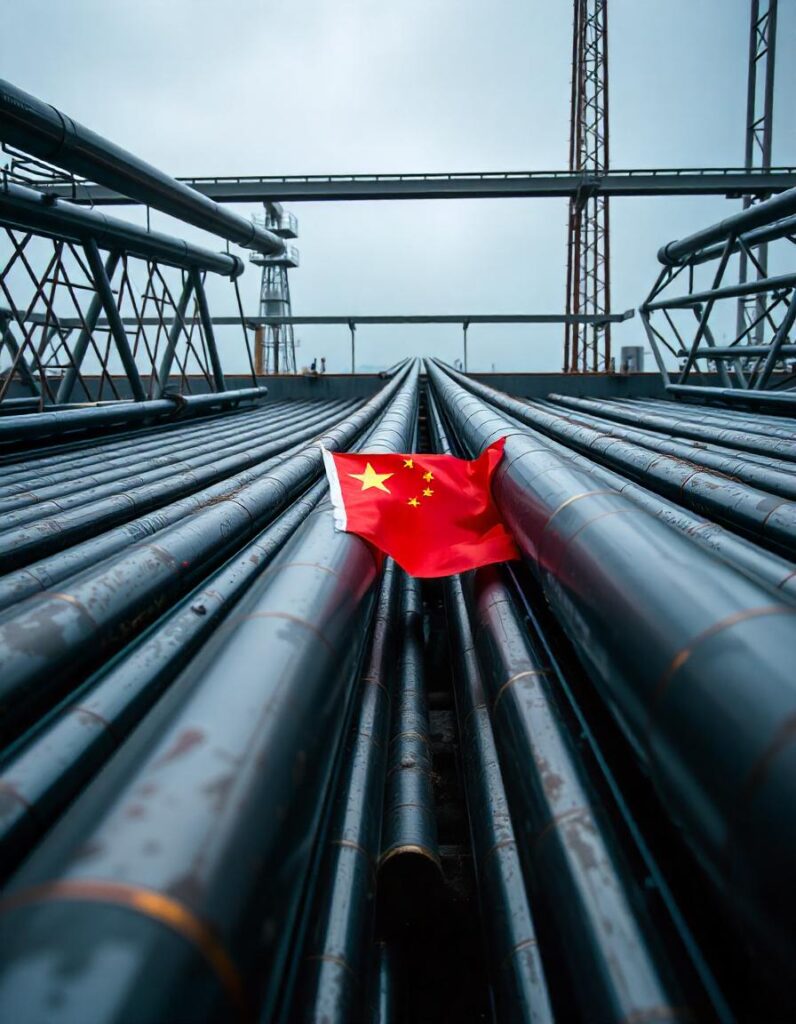

Aluminium and Copper: Rising Prices and Trade Shifts

One of the most significant changes in the rebate system involves the complete removal of export tax rebates for aluminium and copper products. For years, these rebates have allowed Chinese exporters to sell semi-finished aluminium products such as pipes, plates, and strips at competitive prices, driving down costs in global markets.

Producing 1 MW of photovoltaic capacity requires approximately 21 tonnes of aluminum, showing its critical role in solar energy production. The International Renewable Energy Agency (IRENA) projects that global demand for solar power could drive an additional 160 million tonnes of aluminum demand by 2050.

However, as China cancels these rebates, the price of aluminium is expected to rise significantly, as seen in the sharp increase in aluminium futures in London following the announcement.

As Nitesh Shah, a commodity strategist at WisdomTree, points out, “If you’re not awarding rebates, then more metal remains domestically in China, and it could tighten the market in the rest of the world.”

This change presents an opportunity for aluminium producers outside China to benefit from higher global prices. In India, for example, major aluminium players like Hindalco Industries, Vedanta, and National Aluminium Company Ltd (NALCO) are expected to see positive effects, as the cost of Chinese aluminium exports increases, potentially leading to a surge in demand for domestically produced aluminium. However, this price hike will likely result in higher costs for aluminium-consuming industries, such as automotive, construction, and packaging, which rely on affordable aluminium supplies.

Solar Industry: Price Increases and Shift in Market Dynamics

The reduction in export tax rebates also applies to photovoltaic products, including solar panels and batteries, which have been a cornerstone of China’s renewable energy dominance. The rebate for these products will drop from 13% to 9%. China’s share in global solar panel production exceeds 80%, with the country playing a crucial role in reducing the costs of solar power worldwide. As the largest exporter of photovoltaic components, this policy shift will likely lead to higher prices for solar panels and cell components across the globe, disrupting solar projects and possibly slowing down the global adoption of solar energy.

“Rising global solar module prices will not stop the booming Indian solar industry, our module manufacturers are going to become more competitive globally”, says Anuvrat Saboo, SafEarth’s Co-founder.

For India, this development presents a mixed bag. On one hand, the increase in Chinese solar panel prices could create space for Indian manufacturers to become more competitive. With India still heavily reliant on Chinese imports (67.8% of solar imports come from China, according to MerComm Market Research) this price shift could reduce India’s dependency on Chinese products, enabling local solar players like Tata Power Solar, Vikram Solar, and Premier Energies to compete more effectively in the market.

However, India’s solar sector will also face challenges. The country is still struggling with high costs for raw materials, particularly aluminium, which is essential for solar panel frames and mounting structures. Given that aluminium prices are likely to increase globally, Indian manufacturers could see their production costs rise, potentially offsetting any benefits from reduced competition in the solar export market.

Moreover, the country’s limited manufacturing capacity—despite initiatives like the Production-Linked Incentive (PLI) scheme—remains a bottleneck in meeting domestic and international demand.

Way Forward

China’s decision to reduce and cancel export tax rebates for aluminium, copper, and solar products marks a significant turning point in global trade, especially within the renewable energy and metals industries. While this move is expected to elevate prices for these products globally, it presents both opportunities and challenges for nations like India.

Indian solar and aluminium manufacturers may benefit from reduced competition, but the higher costs of raw materials could offset these gains. As the global market adapts to these changes, companies and governments will need to navigate these shifting dynamics to maintain stability and ensure continued progress in industries critical to the clean energy transition.