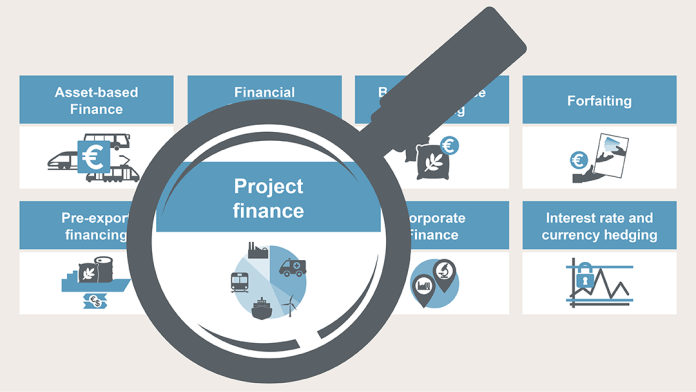

Project financing loans are important, especially for clients and industries such as Engineering, Procurement, and Construction (EPC) that handle projects simultaneously. Tailored to cover project-related costs, these loans enable the acquisition of essential materials and sustain ongoing operations, ensuring the smooth progress and accomplishment of diverse projects.

This is why we at SafEarth provide our clients project financing loans in order to help accelerate their growth.

Definition and Purpose of the Project Financing Loan

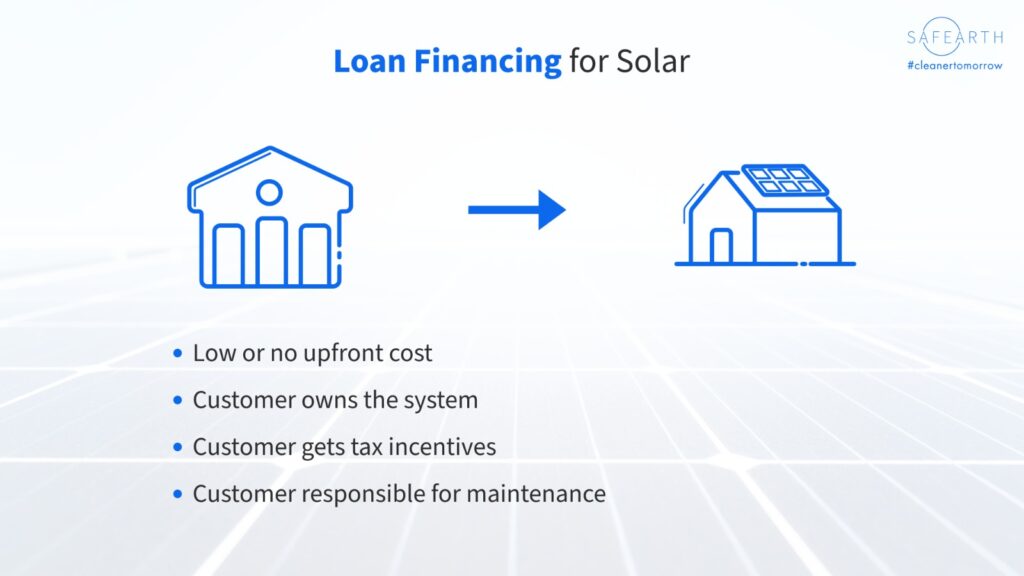

Project Financing Loans are specifically designed to cover long term projects. These loans are particularly used for projects like capital – intensive projects, energy projects and real estate development.

Here are key conditions that borrowers typically need to meet to avail working capital loans:

- Project Feasibility Report : It gives insights into potential risks, rewards, and sustainability, aiding decision-making and securing financing by showcasing the project’s feasibility.

- Balance Sheet: Lenders typically require a thorough analysis of a company’s financial health and performance over the past few years. Providing the last three years’ balance sheets demonstrates the company’s stability, growth trajectory, and financial history.

- Creditworthiness: Lenders assess a borrower’s creditworthiness by evaluating their credit score, credit history, and financial health. A good credit score reflects a history of timely payments, responsible credit usage, and lower credit risk, making it easier to qualify for a loan.

- Cash Flow and Debt Servicing Ability: Lenders assess a company’s ability to repay the loan based on its cash flow.

How Can you get Project Financing for your Solar Project:

Companies can avail Project Financing in 3 easy steps:

- Sign Up on SafEarth

- Click on Request Finance on the Dashboard and Select Project Debt

- Provide Required Documents

SafEarth then, provides you with multiple offers within 48 hours and you can have the loan sanctioned in under 3 days.

Conclusion

For availing loans, there are some conditions that need to be fulfilled beforehand i.e., creditworthiness, balance sheet, etc. Additionally, we at SafEarth help borrowers to choose the loan from different lenders and options to avail the most suitable terms and rates that align with their needs and financial capabilities. If you are an EPC company, looking to grow your business, then we invite you to join the SafEarth platform and make the most of the opportunities that we offer.

Fantastic beat I would like to apprentice while you amend your web site how could i subscribe for a blog site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear concept

It was great seeing how much work you put into it. Even though the design is nice and the writing is stylish, you seem to be having trouble with it. I think you should really try sending the next article. I’ll definitely be back for more of the same if you protect this hike.

Wow wonderful blog layout How long have you been blogging for you make blogging look easy The overall look of your site is great as well as the content