Implementing a solar power plant for your business offers numerous benefits, including reduced operating costs and a smaller carbon footprint. However, the initial expense of installing solar panels can pose a financial challenge. Thankfully, various financing options exist to help cover these initial expenses.

SafEarth is a platform that helps businesses buy the best quality solar plants, in the fastest manner possible, optimizing your returns from the investment and reducing the related risks. It helps you compare quotes, choose vendors, and manage the entire project from start to finish. SafEarth also helps you explore different financing options for your solar energy project, such as loans, leases, and power purchase agreements (PPAs).

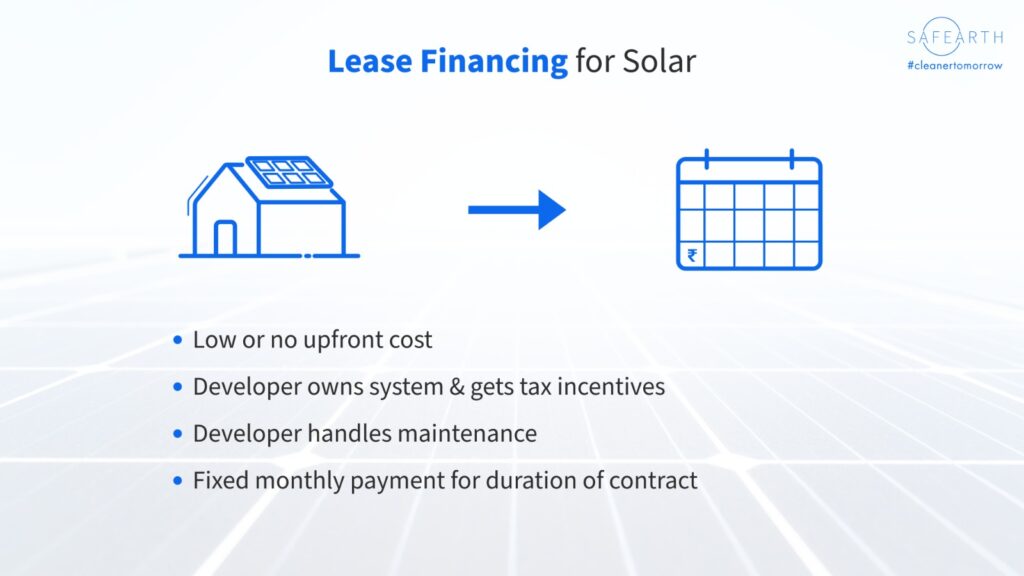

In this article, we cover solar leasing, to help you understand the nuances of this financing option.

Structure:

A third party investor installs the solar plant on your roof. You pay a small (or in some cases no) upfront cost for it. You now pay a fixed monthly payment to the investor.

There are multiple types of lease options available too.

Lease :

- Finance Lease: This type of lease works like a loan. You agree to pay a fixed amount each month for the solar panels, and by the end of the lease term, you usually have the option to own the panels. It’s like paying off a loan to eventually own the solar panels outright.

- Operating Lease: With an operating lease, you pay a regular fee to use the solar panels, but you don’t typically have the option to own them at the end of the lease. It’s more like renting the panels for a certain period, and once the lease is over, you might have the choice to renew the lease, upgrade to newer equipment, or return the panels.

The pros of using a lease to finance your solar energy system include:

- You pay a much lower upfront cost for your system.

- You do not have to worry about the maintenance or repair of the system.

- You can save money on your electricity bills by using the solar energy produced by the system.

- The most flexible option, as you have the lowest lock in period and flexibility to exit.

The cons of using a lease to finance your solar energy system include:

- You do not own the system and cannot claim any tax deductions or rebates for it.

- You have to pay a fixed monthly fee regardless of how much solar energy you use or save.

- You may have to pay extra fees or penalties if you want to end the lease early or transfer it to someone else.

Solar leasing is usually a go between solar financing and solar loans. It offers higher upfront costs than a PPA, while lower than a loan. However, it usually involves a higher recurring payment than a PPA or a loan. The flexibility offered by the leasing options makes it a very attractive option for certain use cases.

At SafEarth, we are passionate about helping the world transition to renewable energy. This is why we have created the most customer centric platform for renewable adoption. Have a look at our platform SafEarth to see the different financing options that we can offer you.