Solar energy is a great way to cut your operating costs and reduce your carbon footprint. But how do you pay for the upfront cost of installing solar panels on your business premises? Fortunately, there are different financing options available for implementing solar energy solutions for your business, and SafEarth can help you find the best one for your needs.

SafEarth is a platform that connects businesses with the best renewable energy solutions in their area. It helps you compare quotes, choose vendors, and manage the entire project from start to finish. SafEarth also helps you explore different financing options for your solar energy project, such as loans, leases, and power purchase agreements (PPAs).

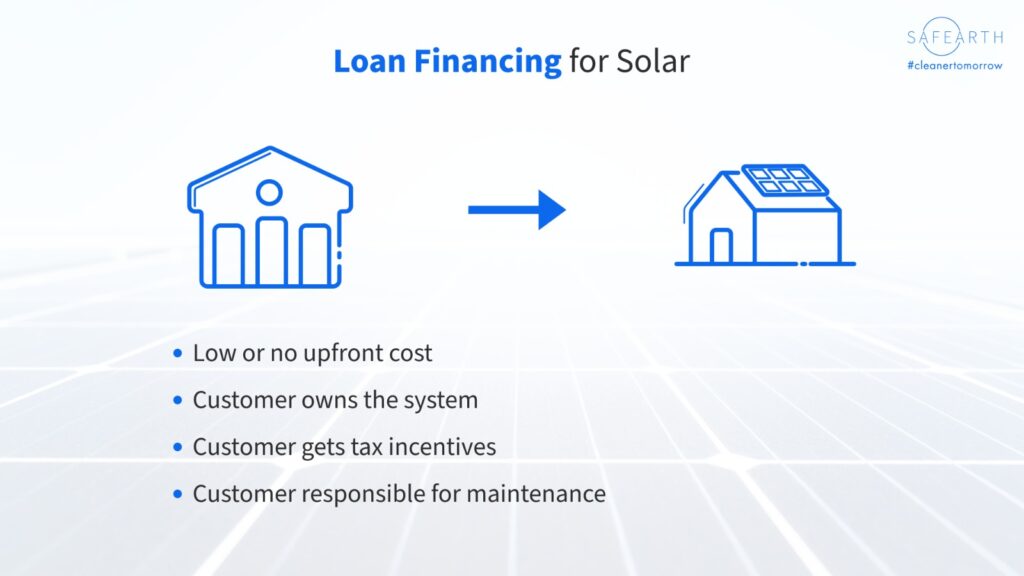

In this article, we cover the various types of solar loans and see what are the pros and cons of this mode of solar financing.

Types of solar Loans :

- Business loans: These are loans that are specifically designed for business purposes, such as solar energy systems. They may have lower interest rates and more flexible terms than personal loans. They may also qualify for tax deductions or rebates from the government or utility companies.

- Equipment loans: These are loans that are used to purchase equipment, such as solar panels. They usually have fixed interest rates and repayment terms that match the useful life of the equipment. They may also offer tax benefits as the equipment is depreciated over time.

- Green loans: These are loans that are offered by lenders who support green initiatives, such as solar energy. They may have lower interest rates and more favorable terms than other types of loans. They may also offer incentives or discounts for choosing green solutions.

The pros of using a loan to finance your solar energy system include:

- You own the system and benefit from its performance and savings.

- You can claim tax deductions or rebates for your system.

- You can increase the value of your property with a solar energy system.

The cons of using a loan to finance your solar energy system include:

- You have to pay interest on the loan, which adds to the cost of your system.

- You have to make monthly payments on the loan, which may affect your cash flow.

- You may have to meet certain credit requirements or provide collateral to qualify for a loan.

At SafEarth, we are passionate about helping the world transition to renewable energy. This is why we have created the most customer centric platform for the adoption of clean energy. Sign up on our platform SafEarth today, to get the best value out of your switch to clean energy.

More Power to you!

Hey there You have done a fantastic job I will certainly digg it and personally recommend to my friends Im confident theyll be benefited from this site