Businesses often find themselves in need of financial assistance, seeking loans to fuel growth, manage inventory, or cover essential expenses like payroll. However, navigating the loan approval process often proves to be a complex and challenging endeavor for companies.

We at SafEarth help you with the loan according to your requirements in order to accelerate your business making the process hassle free and flexible.

Working Capital Loans

Working Capital Loans are specifically designed to cover short term operational needs. These loans are particularly used for projects like short term, inventory purchase and other operational expenses.

- Short-Term Loans: Loans such as short term loans provide the funds to cover the immediate expenses such as payroll, inventory restocking or managing seasonal fluctuations. The interest payments are charged on the monthly basis making the process hassle free and flexible.

- Inventory Purchase: Every company needs to maintain the adequate stock levels and sometimes need financial support for the same. We at SafEarth help you provide the loan with a totally transparent and hassle free process. This loan ensures that businesses can meet their daily requirements and can avoid stockouts.

- Other Operational Expenses: Company requires to maintain other expenses apart from payroll and inventory purchase. These expenses may include rent, utilities, maintenance, marketing and administrative costs. SafEarth extends its support to cover these expenses smoothly and efficiently.

Project Financing Loans

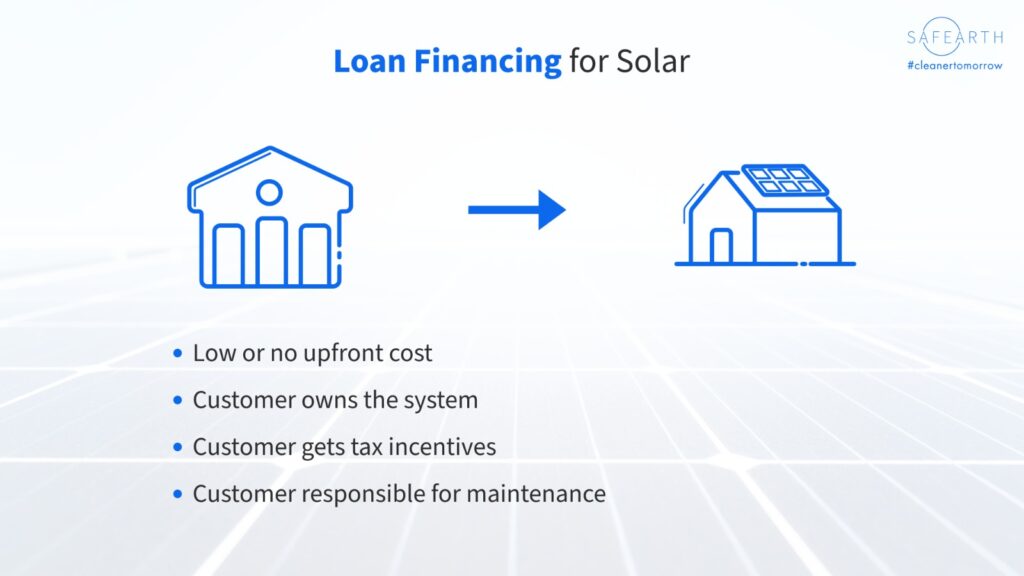

Project financing loans are specifically designed to fund large-scale projects. SafEarth offers various types of project financing loans tailored to diverse requirements that are as follows :

- Real Estate Development Loans: For the EPCs involved in real estate ventures, SafEarth provides financing options catering to their requirements and needs. These loans have flexible repayment structures based on the project to project

- Large-Scale Industrial Loans: Business aiming for expanding can avail the benefit provided by SafEarth through the Project Financing Loan. The repayment of the loan is on the monthly basis making the process flexible and hassle free.

- Energy Project Loans: SafEarth commitment to sustainability reflected by the provision of loans for the renewable energy projects whether it’s wind, solar or hydroelectric projects.

Conclusion

SafEarth’s provision of different loans tailoring according to the different requirements caters to the multifaceted needs of both big projects and day – to – day business operations. By offering specialized financing solutions for distinct purposes such as project funding and working capital requirements, SafEarth stands as a reliable partner for individuals, businesses and EPCs. That’s why we’re committed to crafting the best solutions tailored to benefit our partners in every way possible. If you are an EPC company, looking to grow your business, then we invite you to join the SafEarth platform and make the most of the opportunities that we offer.

hello!,I really like your writing so a lot! share we keep up a correspondence extra approximately your post on AOL? I need an expert in this house to unravel my problem. May be that is you! Taking a look ahead to see you.

I have been surfing online more than 3 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my opinion, if all web owners and bloggers made good content as you did, the web will be much more useful than ever before.