On a planet battling climate change, renewable energy offers us a low cost, sustainable source of power. Amongst renewables, solar is now fast becoming a go to power source of a large number of customers.

One of the key challenges facing solar is the high upfront cost required for setting up a solar plant. This is where solar financing comes into the picture.

There are numerous ways to finance a solar power plant today and each has their own nuances. In this article, we break each one of them down so that you can choose the best one for your needs and goals.

Featured here is the 599 kW plant installed at Ajax Engineering saving 20,997 Tonnes of Carbon per year

DIFFERENT OPTIONS TO FINANCE A SOLAR PLANT

SELF FINANCE

The simplest way to finance a solar project is to buy the whole plant upfront. This includes the cost of the solar panels, the other electrical accessories and the cost of installation of the system. Once you have purchased the solar plant, you also incur costs in the annual maintenance of the system. You now save money by a reduction in the electricity bills that you pay to your electricity provider. All in all, buying a solar plant generates over 20% IRR (Internal Rate of Return) on your capital and hence, is a preferred option.

Power Purchase Agreements (PPAs)

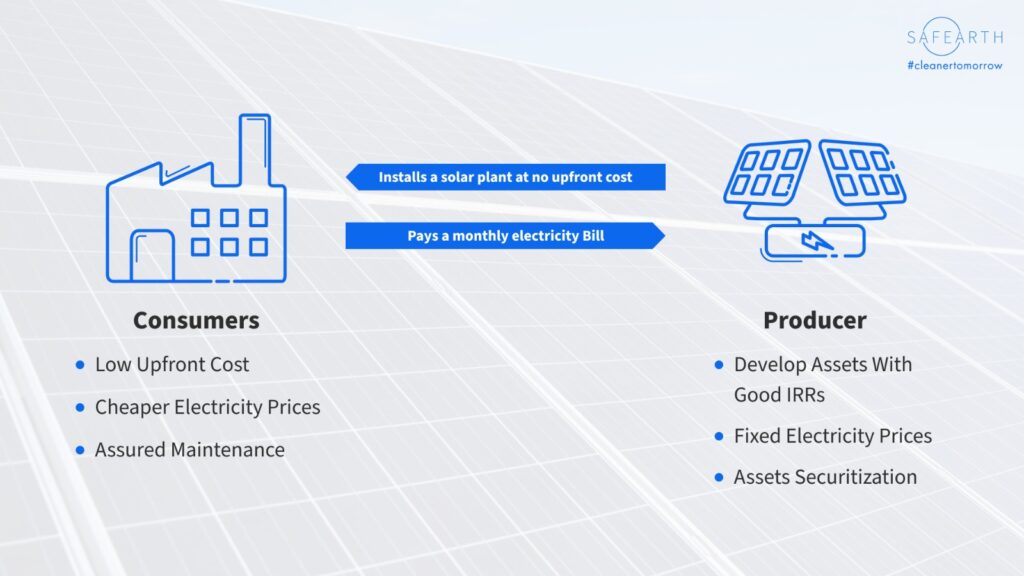

PPAs are common financing mechanisms for solar projects. Under a PPA, a solar developer installs a solar plant for a consumer and pays the entire cost for the same. They are responsible for the operations of the plant too.

The investor then sells the electricity to the consumer at pre – determined rates for a fixed period of time (usually in the range of 15-25 years). In this way, they are able to generate a healthy return on their investment. The power rate is usually cheaper than that cost of electricity from the utility company, hence, the consumer buying solar power also makes a significant savings on their electricity costs.

Solar Loans

Banks and financial institutions in India offer loans specifically tailored for solar projects. These loans are designed to cover the installation costs, and borrowers can repay them over time through manageable monthly installments. Have a look at the attached blog to see more about the different financing options available for your solar plants.

How to Finance your Solar Power Plant with SafEarth

GOVERNMENT SUBSIDIES AND INCENTIVES

Based on the region and the type of the consumer, you can also avail a number of different government benefits and schemes to reduce your electricity costs from solar. One of the most notable schemes is the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) Yojana.

The Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) Yojana has been a game-changer for farmers in Uttar Pradesh. By promoting the installation of 1.9 lakh solar pumps and grid-connected solar power plants, it has empowered over 320,000 farmers in the state to reduce their dependence on traditional grid electricity and diesel-powered pumps. This not only enhances agricultural productivity but also saves farmers significant costs. The scheme has resulted in an estimated 8.8 million liters of diesel saved daily across India, reducing carbon emissions. In Uttar Pradesh alone, this initiative has brought about a transformation, improving both agricultural sustainability and rural livelihoods.

Crowdfunding and Community Solar Projects

Crowdfunding platforms have gained popularity as a means of financing solar projects. Individuals can invest in solar farms or rooftop installations collectively, making clean energy accessible to a broader audience.

The Solar Village Project in Rajasthan, India, is an excellent example of community-driven solar financing. Through crowdfunding, this project provided solar lighting to rural villages, improving their quality of life and reducing their dependence on fossil fuels.

Conclusion

India’s solar energy sector has witnessed remarkable growth. Government subsidies, PPAs, solar loans, crowdfunding, and community solar projects are all viable ways to fund solar installations in the country. As we continue to combat climate change and transition to cleaner energy sources, these financing mechanisms play a crucial role in making solar power more affordable and sustainable for everyone. With the right financing in place, India’s solar industry is poised for even greater expansion in the years to come.

Join our SafEarth marketplace to explore all of these options and transition to renewable energy. Our platform helps you in ensuring that you can make the most out of your transition to renewable energy.

Fantastic beat ! I would like to apprentice while you amend your web site, how could i subscribe for a blog site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear concept

Although I believe every thought you have for your post is excellent and will undoubtedly be successful, the postings are too brief for new readers. Maybe you could extend them a little bit the next time? I’m grateful for the post.

I loved even more than you could possibly be able to accomplish right here. Despite the fact that the language is stylish and the overall appearance is appealing, there is something odd about the manner that you write that makes me think that you ought to be careful about what you say in the future. In the event that you safeguard this hike, I will most certainly return on multiple occasions.