Investing in a solar project guarantees to make you money, every time the sun rises. Solar, is now recognised as a leading asset class that has stable returns for the long term with low risks. This is why a large number of private investors have been turning to solar to add a new flavor to their investment portfolio.

But here’s the catch: not all solar investments are created equal. Whether you’re an investor seeking high returns or a conscientious eco-enthusiast looking to align your money with your values, understanding the nuances of returns on investment in different solar projects is crucial.

There are multiple models to invest in a solar project, and in this article, we are going to explore each one of these, to help you narrow down on the best model for you to reap the rewards of this new, and emerging asset class.

Different Financing Options

Solar Power Purchase Agreements (PPAs) :

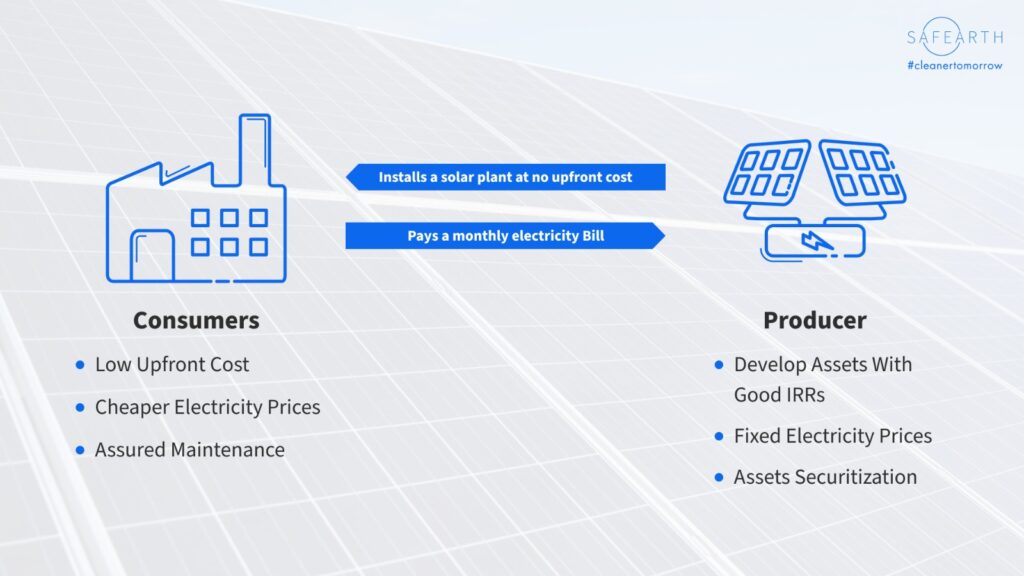

Solar PPAs are the most common financing vehicle for solar projects. Under a PPA, the solar project investor sets up a solar plant for a consumer and sells the electricity to the consumer. The investor owns the asset and derives revenue from the sale of electricity, whereas the consumer gets cheaper, sustainable electricity at predetermined rates.

Win – Win right?

For Example – let us look at the case of Toyota Industries, who bought a solar PPA through the SafEarth platform. Toyota was paying Rs 8/kWh for electricity. The investor now set up a solar plant on the roof of the factory. They now raise an electricity bill at a lower price to Toyota every month. This helps them in making a healthy return on their investment while also reducing the cost and carbon footprint for Toyota.

You can read more about the Solar project at Toyota here : https://safearth-static.s3.amazonaws.com/case_studies/New_Case_Study_Toyota.pdf

Solar Loans :

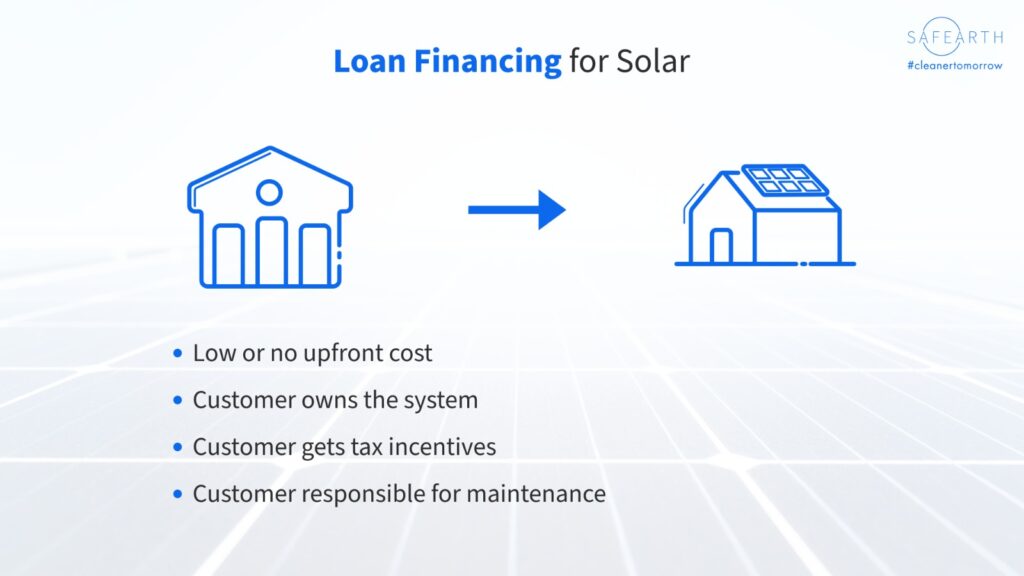

Solar loans are a popular choice for many individuals and businesses in India looking to invest in solar energy. These loans offer the advantage of ownership from day one, enabling the borrower to capitalize on both the savings and the potential revenue from excess energy generation.

Have a look at the attached blog to see more about the different financing options available for your solar plants.

How to Finance your Solar Power Plant with SafEarth

Example: A homeowner named Neha decided to install a rooftop solar panel system using a solar loan of ₹5 lakh at an interest rate of 8%. After installation, her electricity bills reduced by ₹5,000 per month. Factoring in her monthly loan installment of ₹4,100, Neha’s net monthly savings amounted to ₹900. Over a year, she saved ₹10,800. Considering her initial investment, her return on investment (ROI) was roughly 10.8%. Over the life of the system, typically 25 years, Neha expected significant savings and an even higher ROI due to rising electricity prices.

Solar Leases :

In a solar lease, a customer simply rents the system from a third party. They pay fixed monthly lease costs to the asset owner and save money by a reduction in their electricity bills.

Example: In India, a residential customer named Ramesh opted for a solar lease to reduce his electricity bills and carbon footprint. He leased a 5 kW solar panel system for 20 years at an affordable monthly fee of ₹5,000. With this system, Ramesh saves approximately ₹2,000 per month on electricity bills. Over the 20-year lease term, his total savings will amount to ₹4,80,000. Considering the lease cost and electricity savings, Ramesh is expected to achieve an impressive ROI of around 150% by the end of the lease term, making it a smart and environmentally friendly investment.

Government Schemes and Subsidies :

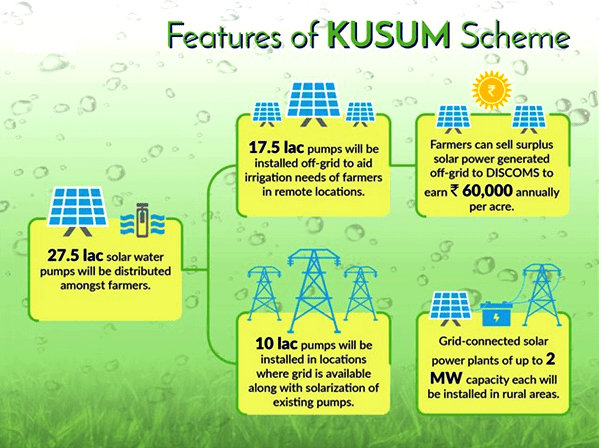

The Indian government has launched several initiatives and subsidies to promote solar energy adoption. These schemes offer financial incentives, tax benefits, and other advantages that can significantly improve the ROI of solar projects.

Example: In India, the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme offers financial incentives to farmers for installing solar pumps. Suppose a farmer invests 2 lakh rupees in a solar pump system. With a government subsidy of 60%, the farmer receives 1.2 lakh rupees back. The solar pump generates an annual income of 50,000 rupees by saving on diesel costs. Over five years, the farmer not only recovers the initial investment but also earns an additional 2.5 lakh rupees, resulting in a significant 250% return on investment (ROI). This scheme not only promotes clean energy but also boosts the financial well-being of farmers.

Features of the PM – KUSUM scheme

Link : https://www.drishtiias.com/daily-news-analysis/pm-kusum-1

Conclusion

Investing in solar projects can be a highly profitable venture, and you can choose different models based on your own financial goals. Before making any investment decisions, it is essential to conduct a thorough financial analysis, consider local incentives, and consult with solar experts to ensure the best ROI for your specific circumstances. As solar technology continues to advance and costs decrease, the financial benefits of solar investments are likely to become even more attractive in the years ahead.

If you are looking to see how you can make the most out of solar energy, book a call with SafEarth – India’s leading marketplace for investing in solar.