The high upfront cost of a solar power plant is the biggest deterrent that most people face in adopting this clean source of power. Fortunately, today, there are multiple ways for a potential user to finance their solar power plants.

Before looking at ways to finance your solar transition, let us understand some benefits of doing so. Solar power is the cheapest source of electricity today, helping you reduce your electricity bills for the next 25 years. Not only do you get lower cost energy, but you also no longer have to worry about an increase in electricity prices. What’s more, solar is an environmentally friendly source of energy, helping you do your bit in the fight against climate change.

So, now, let us look at the different ways that you can finance your solar plant.

Solar Loans

Loans can be a helpful way to finance your solar energy system. There are different types available for businesses:

1. Business Loans: Tailored for business purposes like solar energy systems, these loans might offer lower interest rates and flexible terms compared to personal loans. They could also qualify for tax deductions or rebates from the government or utility companies.

2. Equipment Loans: Specifically for purchasing equipment like solar panels, these loans typically have fixed interest rates and repayment terms aligned with the equipment’s useful life. They might also offer tax benefits as the equipment depreciates over time.

3. Green Loans: Offered by lenders supporting eco-friendly initiatives, such loans may provide lower interest rates and more favorable terms than other loan types. They might also come with incentives or discounts for choosing green solutions.

Pros of using loans for solar energy:

- Ownership Benefits: You own the solar system and benefit from its performance and savings.

- Tax Advantages: Possibility to claim tax deductions or rebates for your solar system.

- Property Value Increase: Installing a solar energy system can increase the value of your property.

Cons of using loans for solar energy:

- Interest Costs: Additional costs due to paying interest on the loan.

- Monthly Payments: Impact on cash flow due to required monthly loan payments.

- Qualification Requirements: Possible need to meet credit standards or provide collateral to qualify for the loan.

In essence, loans for solar energy offer ownership, potential tax benefits, and property value increase. However, they come with added costs such as interest and monthly payments, along with potential requirements like good credit or collateral. SafEarth can guide businesses in choosing the right loan option for their solar energy projects.

To understand solar loans better, refer to this article here,

SOLAR LOANS

Leases :

You also have the option of leasing your solar plant for a solar lease provider. When leasing a solar plant, you pay a fixed monthly lease for it. You may also have to pay a small upfront cost.

The pros of using a lease to finance your solar energy system include:

- You pay a much lower upfront cost for your system.

- You do not have to worry about the maintenance or repair of the system.

- You can save money on your electricity bills by using the solar energy produced by the system.

The cons of using a lease to finance your solar energy system include:

- You do not own the system and cannot claim any tax deductions or rebates for it.

- You have to pay a fixed monthly fee regardless of how much solar energy you use or save.

- You may have to pay extra fees or penalties if you want to end the lease early or transfer it to someone else.

To understand solar leases better, refer to this article here,

SOLAR LEASE

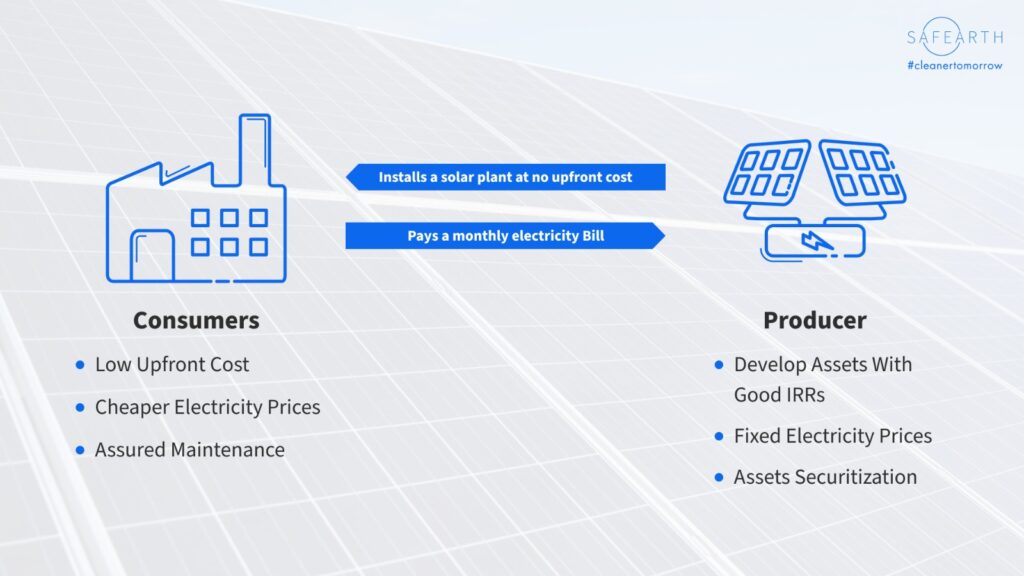

Power Purchase Agreements (PPAs) :

A PPA is the best route to finance your solar plant, if you wish to avoid the upfront cost of the system. In a PPA, you do not have to pay for the system, instead, you pay for the electricity produced by the system.

The pros of using a PPA to finance your solar energy system include:

- You do not have to pay any upfront cost or interest for the system.

- You do not have to worry about the maintenance or repair of the system.

- You can save money on your electricity bills by paying a lower rate for solar energy than for grid electricity.

The cons of using a PPA to finance your solar energy system include:

- You do not own the system and cannot claim any tax deductions or rebates for it.

- You have to pay for the solar energy you use regardless of how much you save or need.

- You may have to pay extra fees or penalties if you want to end the PPA early or transfer it to someone else.

To understand Power Purchase Agreement(PPAs) better, refer to this article here,

POWER PURCHASE AGREEMENT (PPA)

Conclusion

Do not let the cost of a solar plant deter you from saving money and the environment by shifting to solar power. There are many ways to solve this and we at SafEarth have made it all the more easier through our customer centric platform for solar adoption. We help you with everything, from engineering to financing and then installation to ensure that you can make the most out of your transition to renewable energy. Speak to our solar experts today to see how you can benefit from the switch to clean energy.

Wow superb blog layout How long have you been blogging for you make blogging look easy The overall look of your site is magnificent as well as the content